Apple Card

Apple's Cash Back Card

Annual Fee

$0

Earning Rate

3% Apple & partners • 2% Apple Pay • 1% everything else

Welcome Bonus

No welcome bonus

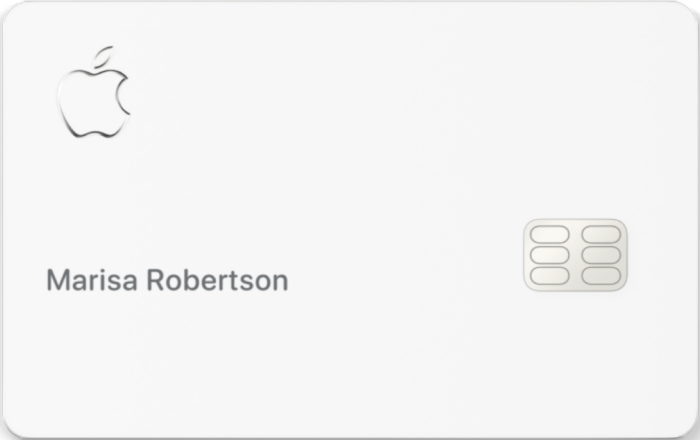

Card Material

Titanium card with matte finish

Practical Recommendation

This is a simple cash-back card that shines if you live in Apple Pay. You get 3% back at Apple and a short, vetted list of partners, 2% back anywhere that takes Apple Pay, and 1% when you use the physical card or type the number. No annual fee and no foreign transaction fees keep it friendly.

If you buy Apple hardware, the interest-free monthly installments are genuinely useful, and Daily Cash posts fast. If most of your spend is swipes or online checkouts without Apple Pay, a flat 2% cash-back card will usually earn more. Bottom line: Apple fans and tap-to-pay people will be happy; everyone else should compare.

Perks

- Earning structure (quick recap) – 3% at Apple and select partners when paying with Apple Pay; 2% with Apple Pay everywhere else; 1% with the physical card or card number. Good everyday value if you can use Apple Pay often.

- No fees (including foreign transactions) – No annual fees, no late fees, no over-the-limit fees, and no foreign-transaction fees. Helpful for travel and for keeping costs predictable.

- Daily Cash (posts fast) – Cash back accrues daily and can be used, sent, or moved to Savings. Nice for instant gratification vs. waiting for monthly statements.

- Apple Card Monthly Installments (interest-free at Apple) – Pay for eligible Apple products over time at 0% interest when you choose installments at checkout; still earns 3% Daily Cash up front. Great for big Apple purchases without paying interest.

- Apple Card Family – Share the card, set limits, and help authorized participants build credit (adults) while pooling Daily Cash. Useful for households.

- Virtual card number & privacy – Use a rotating card number from Wallet for sites that do not take Apple Pay; the titanium card shows no numbers. Reduces exposure from merchant breaches.

Protections

- Zero Liability – You are not responsible for unauthorized charges if you report them promptly. Peace of mind if your number is compromised.

- Mastercard ID Theft Protection – Monitoring and assistance if your identity is misused. Good "just in case" coverage. Enrollment required.